Issue 4

Issue 3 (this one)

Issue

2

Issue

1

StanInvest Fri

19 Dec 2003 10PM

Why must the stock market collapse.

The short answer is because at the present valuations almost all companies can make a living by simply diluting gradually their stock without producing anything.

Example 1.

Let us take a hypotetical manufacturing company

in Canada (based loosely on CDV.TO in 2003, but with higher earnings) in the

high tech sector that has a market cap of 200M$ and a turnover of 100M$/y.

Let their gross profit margin be 20% (20M$/y) and net income 5% (5M$).

All in CAN$ By diluting their stock by just 10%

every year they can raise as much cash as by their operations. Conversely

they could in theory, simply stop or fake their operations and run the business

by selling the stock alone. Or by diluting their stock by only 2.5%

they can double the income!

Example 2.

Retail sector, US company WMT in

2003. Market cap=231B$, Gross profit=56.9B$, net income 8.7B$

(P/E=26.7). All in US$. Again, by simply diluting the stock

by 25% every year, they can raise as much cash as out of their entire

operation. This can be repeated indefinitely as long as the valuation (P/E)

would persist at the current level. Alternatively, the company

may choose to dilute the stock by just 3.7% to double their net income!

Example 3.

A high tech company in Canada (ATY.TO), for

2003. Market cap 4.7B$, turnover (=revenues) 1.4B$, gross profit

(=gross margin) 0.433B$, net income (=earnings) 0.035B$, EBIT=0.045B$ (all in

CAN$).

Surprizingly this is even more overvalued than

CDV!. In this case, all this company needs to do is to dilute their stock

by only 9.2% every year in order to generate all the cash necessary plus

profit! Dilution of the stock by just 1% would double their

earnings!

Example 4. (updated 23/12/2003)

Research In Motion (RIM.TO). Market cap

4.9B$ (US$), Gross Profit (Margin) incl recent quarter, for the last 4 quarters

2003, estimated at up to 200M$ (US). That is Gross

Profit constitutes 4% of the market

capitalization. Therefore RIM could in theory finance their

entire year of operation by issuing (diluting) just 4% of their stock, and not

selling a single StrawBerry ! They achieved a record 16M$ of profit

in the recent quarter. Suppose that they double this profit in the

next year, that is in 2004 they get 32M*4=128M$ of profit, this would

constitute only 2.6% of their current stock value! What a

temptation...

Comment [ranting mode=ON]

Such situation is highly abnormal and cannot persist indefinitely. A temptation to manufacture stock instead of products or services is just too high and we witness more and more businesses succumbing to it, especially in the high-tech, telecommunication, biotechnology and recently in the mining sectors. This situation not only allows non-viable companies to function to the detriment of others, but it also enables distortions and manipulation of profit figures and consequently the stock valuation, by those less than honest. This stock bonanza seems a classical case of being too good to be true. Another factor is that there is a dramatic disparity between the public companies and small businesses. Public companies can generate a supposedly free cash out of nothing, while small private companies are totally cut off from most forms of funding. Not only such disparity cannot persist, and The Market always finds a way to rectify the imbalance and restore harmony, but such misappropriation of resources increases unemployment since big public companies destroy jobs while small private ones create them.

Note that the sole reason for this situation

is a persistently high valuation of the stock. This mechanism would not

be feasible or not that easily applicable if the stock was worth one-third to

one quarter of the present value. So it must be, one day.

StanInvest Thu

18 Dec 2003 2PM

"Saving The World" disease or

uncontrollable ranting rampage of S & S

From: Stan

B. To: Stan

P. Sent: Wed, Dec 17, 2003 4:25 PM

Subject: StanInvest

I am sure you will see it yourself, but I

can't stop wondering at the speed of the dollar fall, and the lack of

response! It is now 1.24eur/$, gold touched 413$, silver touched

5.70, platinum at the peak (838$), the correction in gold stock is

half-hearted, and the US stock market seems to be ignoring it.

Business as usual, very weird! This inaction is the most

puzzling. They are playing "chicken on the road"

game. Unless they know something; a future event may be, that

we don't. Stan

From: Stan

P. To: Stan B. Sent: Wed, Dec 17,

2003 8:07 PM

Subject: Re: StanInvest

Hi Stan

[how about some Polish

politicking?]

I cannot understand why you are

wondering at all. It is in the best interest of the United States to let the

dollar fall. It was greatly overvalued in the first place.

Greenspan is no fool. He knows the trade deficit is not sustainable and he knows protectionism is even worse. He has to change the price structure. He knows China and India will need resources which are in short supply. So their price has to go up. Food will go up (it already does). Fish is disappearing worldwide. Atkins is becoming quite popular. Energy is way too cheap. Natural gas shortage is already on the horizon. US labor has to go down as a percentage of cost even if it means lower standard of living. One reason foreigners financed US borrowing is political stability. Despite looks to the contrary current conflicts are quite small and local. Worldwide there is less need to stash cash in a safe location. It all means DOLLAR HAS TO GO DOWN WITHOUT WAGE INFLATION. US consumers must take a haircut!

People cannot catch on what is going on because there was never anything like it. We all had 1.5 century of rising wages and rising standard of living. Now we have inflation of assets, including raw materials with no inflation in final prices and wages. This means the "purchasing power" is slowly going down. It has to. This will continue until dollar falls so much that job hemorraging will stop. After all transport costs money and US industry is much more efficient. Of course at some point the inflationary spiral would start, but the FED has an ultimate weapon. They can raise rates and stop the process any time they want.

You have sent me many times articles about three trading blocks. There is a lot of truth in it. Europe has chosen protectionism. They want to keep the status quo by keeping borders shut. The population is shrinking. Everybody has a home and a car. They have plenty of food. They need oil and they can buy other resources in Russia. This is a stable model which WILL work

American block chose growth. They probably know MBA's are useless while their workers are too expensive. They cannot lower wages, but they CAN make chinese unwilling to work for nothing.

Asia will rely more on the domestic market. They too want cars, TV's and Whistler vacations. With less dependency on US market they will accept the new deal (lower dollar, higher commodities, less exports). In addition China needs cash to bail out state enterprises. Sooner or later this crisis will erupt and will eat into their foreigh reserves. Finally it will become much more expensive to subsidize Kim Jong Il.

I have promised myself to stop politicking. I will not do it again. But I want you to forget the details and look at the big picture. There are some clearly visible trends in world economy. These trends cannot be stopped. The forces in play is livelihood and ambitions of entire nations. The trends cause stress which cannot be sustained. It will NOT be sustained. It will find a new equilibrium. Where is this equilibrium and how to get there. The market tells you: much lower dollar, much higher commodities. The FED knows better then to try to stop it.

Look at it differently: US infrastructure (sewers, roads, railways, cities) is crumbling from years of neglect and needs to be rebuilt. Chinese and Indians never had it and need to build it. It is very capital and labor intensive. They all will need a lot of copper, iron, zinc, nickel, plastics etc... I think I have missed how powerful this rally will be! What is in demand, goes up. What is in oversupply (like computers), goes down.

Food is a different story. I have no idea if chinese can feed themselves once they start eating meat like us. But the cattle feed is already going up. With canadian supply shut down and Atkins becoming the most popular diet the US is running out of meat! It may be a fad, but it is already changing farm economy in the US.

What does it mean for Canada.

Not much. We are 50% resource 50% industrial production. My guess is the CDN

will stabilize around 0.75 to 0.80 US and will go down against all other

currencies. Reason: US takes 80% of our exports. We cannot go back

to 100% resource based economy, so the dollar cannot go much higher. It cannot

go lower either. We have lower productivity. We need to lower our

dependancy on cheap labor (it is no longer this cheap) and invest capital in

machinery to enhance productivity. 0.80 cents seems like a good balance.

[rant off]

Seriously. I think the rally in CDN is almost over, but the Euro and Yen will gain a lot. I would NOT be surprised to see 2 Euros or 50 Yen to a dollar. Since the Europe and Japan is the biggest consumer of Platinum this may mean 1000/oz, but only in US currency. This may also mean $500-$600 gold with the world price stable. This is why I have started to buy US mining stocks like OTZ. In may 04, when they will open this mine in New York the zinc may be U$1000/ton. I told you many times I do not believe in $500 gold. Like most people I missed a basic fact: The price in Euros or CDN did not move at all. It is all a play on the dollar! Is the US economy in equilibrium. No, thus the dollar HAS TO go down and the gold will go up. I have accepted it. I also think Canada will lower rates if the dollar fgoes over 0.80 cents. If so, Canadian miners will immensly benefit. Once again, I thought higher gold will increase supply. NOT REALLY, because the cost and revenue in local currency has not changed at all. Though I think the cost of new mining equipment will fall (made in USA syndrome). Finally, I think Europe cannot lower interest rates even if they wanted too. Their problem is cultural, structural and fiscal, not monetary. Flooding Europe with cheap money will only bred waste and more inefficiency. Besides, you can hardly have more government!

As of today I am fully

invested. I have no cash left. I did it a bit too early and lost some money,

but I did it nevertheless. I have listed my reasons above which is also my

answer to your "puzzle". And it is not "this fast" at all:

count the percentages per month! Stanley

Stan B.i wrote:

I can't stand Polish politicking. Getting back to USA, I understand that the dollar is overvalued relative to other currencies. However the proper way of achieving it is revaluating the Asian currencies, just like the European currencies appreciated after the WWI as these countries rebuilt their economies. Deutschmark used to be worth 4 US dollars in the 1950-ties. The problem with devaluation of the dollar to save the budget and trade deficit is the wrong solution. That is, it will work, alright, but it will wipe out the savings of the people and probably most of their paper assets. Note that if the currency was backed by some stable assets (let me utter it very quitely - g o l d ), the whole problem would not exist. US gov would not be able to create unlimited trade credit by printing TBonds, which would then be bought by Asian countries and used to rectify their trade imbalance. US is paying basically in T-bonds, therefore no T-bonds - no trade, unless there is real money left. Which there isn't. I define the real money as a carrier of payment that has approximately fixed amount globally, and cannot be easily destroyed or created by some central bank at will.Na razie,Stan P.S.How is your work, has it been clarified?

----

Re: Food is a different story. I have no idea if chinese can feed themselves once they start eating meat like us. But the cattle feed is already going up. With canadian supply shut down and Atkins becoming the most popular diet the US is running out of meat! It may be a fad, but it is already changing farm economy in the US.

I have seen somewhere estimates, that of all the arable land, only 30% at best can be used for tillage, growing plant crops for humans and animal fodder. The remaining 70% of arable land can and should be used as pastures, for grazing cattle. This has a tremendious implications. Vegetarianism might not help here much, since you would be stuck with that 30%. Plus only a small fraction of that 30% can be utilized with less capital intensive methods. Most tillage requires fertilizers (=energy resources) intensive machinery (=oil) and irrigation (=energy+water resources). Most India is vegetarian and they do not strike me as being particularly efficient or well fed. Last but not least vast majority of plant is really suitable as fodder for herbivorious animals, and those that are versatile and nutrient dense are also high in starch (=diabetes risk) or veg oil (=cardiovascular risk). I think the full article on this might be at www.second-opinions.co.uk .

Re: investing in US mining industry.

This might work and I hope it will work for you. I am not so sure about base metals like Zinc. If the Asian boom comes to a halt, and it must, since nothing goes straight up, plus this dollar thing etc, it will reduce demand world wide. Temporarily of course, since this will be just a cycle. Precious metals OTOH have much bigger role during troubled times as an asset preservation vehicle. I am also fully invested but I only have one zinc turkey (EXR) that I was left with accidentally. I was experimenting in trying to catch a flying turkey by the feet, and you can guess...

----

Stan, I had to separate my reply into pieces, since each issue requires a careful consideration. I hope you don't mind this, even though my replies may look like dissecting your oinions or debunking, but it really is not. I am not that sure at all about my point of view; it should be treated like a contribution to a discussion, an addition to what you wrote rather than the ontradiction.

Re: I told you many times I do not believe in $500 gold.

Most people don't believe either, that's why it probably will get there! I think it is very fortunate for the US government that so many people (not only you) believe in the dollar, which allows them to continue what there were doing (I am not saying it's bad!). Otherwise they would have had a much narrower scope of maneuvre and would have had to do something about it, a lot sooner.

Re: Like most people I missed a basic fact: The price in Euros or CDN did not move at all. It is all a play on the dollar!

It has not moved until now but it probably will. Other government have also run budget deficit and are also more interested in devaluing their currencies rather than keeping value. In addition, there will be a growing pressure to devalue their currencies to prevent trade from collapsing. Again, I am not saying it's bad or sinister. Governments tend to choose a path of the least resistance and a minimization of the short term pain. The orderly devaluation is such a path. Too bad for the retirees and savers, but somebody has to pay. Because of this, gold & silver (especially at a time of currency turmoils), industrial metals (subject to cyclical recessionary forces) as well as energy and food will have to rise in other currencies as well. I give it 99% chance, like in the communist elections... 8-:)

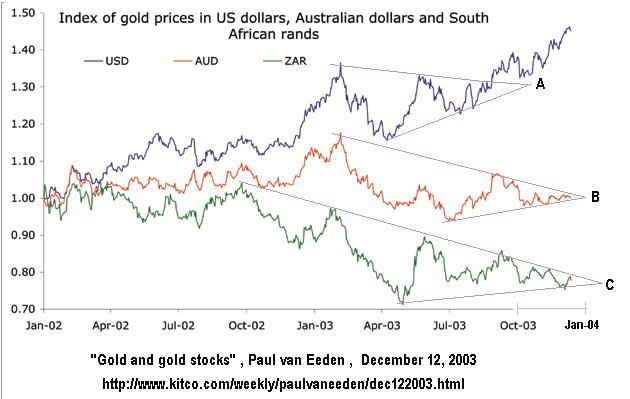

For example, those charts I sent you showing gold in 3 currencies, appear to indicate that technically, such a breakout point may happen quite soon, may be even in January 2004, based on the classical technical analysis.

This will probably be beneficial to the agricultural producers like India, China, Indonesia, Africa and mining economies like Australia, Canada, S.America etc, which is not surprizing since these sectors have been in a severe downturn since 1950-ties. Like everything this is also cyclical. Conversely, production of high tech gadgetry will probably follow now the way of the textiles.

Re: Once again, I thought higher gold will increase supply. NOT REALLY, because the cost and revenue in local currency has not changed at all. Though I think the cost of new mining equipment will fall (made in USA syndrome).

Even if gold goes up in all currencies, eventually, it may in fact boost production but it won't change much since the amount of gold produced per year is of the order of 1% (very roughly, quote from memory) of the total amount in the circulation. That's the beauty of it. Another interesting aspect of the whole situation is that it really cannot be fully predicted. There are many potential factors and events that may change all this.

----

Stan P. wrote:

[...] You are right about asian currencies. The problem is NONE of these countries will allow their currency to appreciate if they can help it. One reason: it is still a feudal social model. My [polish politicking] was in form but not in substance.If you have read it you would see it is quite a change for me.I finally accepted a $500 up gold and a weaker dollar. This will happen even though I think US economy is truly recovering. Nortels will NOT go bust. Not in THIS cycle.I simply concluded writing off the USA is premature. [...] S.

Re: Nortel going bust

Based on what I have seen, no company of

that size ever went bust even if they didn't do anything profitable or had no

product. At this size the opportunity to raise finances and the amount of

capital per employee is so enormous, I mean really HUGE - that they can

literally finance their wages and keep themselves employed indefinitely(*),

without really doing anything. EXCEPT - and that is a critical

point - when/if the interest rates rise way above the real rate of inflation,

then their debt burden may become unbearable and they may collapse. That

happen in 1976-1981.

[...]

------ Footnote ------------

*) One example, ComDev: about

200 employees, turnover 100M CAN$/y, market cap 200M CAN$. They could

easily raise 100M CAN$ by issuing debentures or diluting stock 1.5:1 and

that amount would have been sufficient to pay 50,000 CAN$/y for all the

employees for 10 years (excl. taxes)! ComDev already did such

operation in 1996-2001, when they were buying telecoms. It's as if

somebody gave you a 0.5M loan for nothing! Another example, Nortel

employs now 30,000 people and early this year they raised 1.5B CAN$ by selling

their stock (at 1.5 CAN$/share). That 1.5B CAN$ may in theory have paid

all their wages for 1 year, this year they can repeat this game and easily sell

another chunk of stock (at 5 CAN$!!!) worth 1.5B$. Who is really paying

for all this? Present and future retirees.

StanInvest Thu

18 Dec 2003 1PM

Goldfiles (8)

Radius Exploration Ltd. RDU (1.5C$)

Cap=34M$ US

Resources: Tambor (Guatemala) = 216000oz

Au = 88M$ US

Res/Cap = 2.6

Comment #1.

They have unusually small resources or conversely,

very high valuation. I noticed that many mature junior exploration

companies have Res/Cap ratio of about 10 or higher, with the exception of some

companies headed by what appears to be widely acknowledged specialists with

outstanding managerial record, and with the strong possibility of new

discoveries (did you check this?). Which may happen, however such a

possibility is already probably fully priced into the stock. If it

does not happen, then the stock may go back down by a factor of 4 or so.

Comment #2.

Technically this is a very interesting

situation, and quite classical: the stock has been trading within a so called

"rising chanel" formation, since Feb'02 until early Dec'03, with a

Max/Min ratio of fluctuation range of 1.5. It was quite regular and

stable. However, 2 weeks ago it appeared to have broken downwards

out of this formation, which technically is a very bearish sign!

===

Re: "...and the previous owner

of the property is Gold Fields of SA"

This is precisely what bothers me about

companies like this. But, who knows?

===

Yes, that guy is Simon Ridgeway. Apparently there something going on at V.PRI, which is one-third of the cap of RDU (PRI cap=11M$ US) yet has the resources on only one of their properties claimed to be perhaps worth ("similar to") 380M$ US. That might give the PRI a ratio R/C=35. Stan

Exhibit #1:

http://www.stockhouse.ca/bullboards/viewmessage.asp?stat_num=6994615&all=0&t=0&archived=Archive&link_symbol=RDU&link_table=list&navmode=1&navd=rev

--------------

SUBJECT: Radius/Pilagold

Relationship? Posted By: newmadrid

Post Time: 11/13/03 02:07

« Previous Message

Next Message »

Can anyone on this board

shed any light on the relationship between Pilagold (PRI.V) and Radius,

both of which claim Simon Ridgeway as their president, and both of which

are actively exploring and drilling in Central America (Guatamala,

Nicaragua). Makes me wonder if the two will merge at some point down the

road, or at least engage in some JVs in the area. Or could one be a buyout

candidate for the other (which might be a conflict of interest, given

Ridgeway's role with both companies). Any insights? As a PilaGold shareholder,

I'm mostly impressed with the work Ridgeway has done in Central America,

including his drilling successes with Radius. I'm hoping for more of the same

with his new venture.

---------------

Exhibit #2:

http://www.pillargold.com/home.htm

----------------

ABOUT PILLAR RESOURCES

Pillar is one of a group of

progressive junior resource companies that includes Radius Explorations Ltd.,

which has been actively discovering and defining gold resources in Central

America since 1994.

We have an aggressive

exploration strategy, focused on gold, managed by a team with an 8-year history

of exploration and discovery in Central America. We have experienced and

motivated staff, and access to the region's premier gold projects. In short,

strength, stability and perseverance. These factors lie at the core of our

growth strategy. We are currently drilling some of the most prospective targets

in the important emerging gold belts of Guatemala and Nicaragua.

In Guatemala, we are

drilling the bulk-tonnage Cerro T Zone -a hot springs gold system- on the

Marimba property. Cerro T is similar to San Martin in Honduras (38-million

tonnes at 0.77g/t gold), discovered and outlined by Pillar management in the

late 1990s. Grid drilling of Cerro T will begin in late July, 2003.

Also in Guatemala, the Banderas & Holly properties, located along the

Jocotan Fault west of Marimba, host a series of high-grade, epithermal gold and

silver zones. Trenching is underway at Banderas and drilling is planned for

late July/ early August 2003. In Nicaragua, we hold more than 1,000 sq.

km of highly prospective ground including nine defined gold targets that are

close to drill-ready. If you have any questions or comments after

visiting our web site, please feel free to contact us and we will be happy to

assist you in any way possible. You'll find our phone, fax and e-mail contact

details below.

=====

It is getting more interesting as I keep looking (not necessarily bad though). Three out of 5 PRI directors are also at the same time RDU directors. From the point of view of the investing in the management, investing in PRI seems perhaps as good or better than in RDU. Why did Ridgeway in fact split his exploration projects among those 2 (or more?) separate companies? I would have thought that it is easier to raise financing and safer to operate having a higher mass. On the other hand, perhaps one may be a high risk type and high return, while the other one may be low risk low return, so as to protect the less volatile assets? You must have spent more time poring over their finances, at least for RDU; did you dig out anything interesting that might explain it? Stan

P.S.

Did you notice how many of them are

geologists? Very refreshing and a huge contrast from seeing all these

typical hords of MBA's and accountants listed on the boards of high-tech

<SPIT> companies, and not a single fu cker may be even an engineer!

=====

Stanley P. wrote:

This makes me

extremely nervous. Why an executive would want to run two companies unless he

needs one to parachute to (possibly with all the gold). This

reminds me of company M..x and its directors. It is easier to arrange

financing for a bigger entity unless you are playing games. What’s

more I have seen the Pillar drilling results and they did not impress me

either. Their market cap is low for a good reason. What is going on here?

S

Yes it does resemble M.

but even more so CDV and THL scam. But in the CDV case, THL was

[probably] setup by the directors to appropriate the business sale

commission and take it off the CDV balance sheet. In case of PRI &

RDU the real purpose isn't clear and, unlike CDV where the intention to defraud

can be [probably] easily proved, it may in fact not be fraudulent at

all. I would somehow trust geologists more than MBA's, though not

in 100%. I suspect it may be the risk-management, in the mathematical

sense. If PRI is a very high risk operation, that is they may get 1Moz or

nothing (see their prospectus), then splitting it from RDU will protect those

216,000oz of gold that they have already got, in either case. Although

the investors may have overbid RDU slightly out of control based on CEO

reputation, there may be nothing illegal in it. Stan

StanInvest Fri

12 Dec 2003 4PM

S2S Gold Wedge

Technical analysis speaks of the major

formation called "wedge". It is interpreted as a pre-breakout

formation, indicating the imminenent big raise or fall in the stock or indices.

The following graph shows the price of gold in

3 currencies. Interestingly prices in AUD and ZAR extrapolate the break

out point at January period (points B and C). The price of gold in

US$ however, broke out in September (before point A). My

interpretation is that so far, US dollar has begun its decline cycle in

September, and gold $ price is simply an artefact. However, other

currencies' wedge formation might indicate that the true gold price breakout

(most likely upwards) will probably happen in January 2004.

The other reason behind it, is that it will probably take the full quarter for

other countries to fully believe that US$ is really shot and that will make

them compelled to devalue their currencies (covertly) as well, to compete.

StanInvest Fri

5 Dec 2003 11AM

S2S

Stan P. wrote:

I had a

reaaly bad night tonight so I got up early and turn on the TV. Bloomberg TV had

an interview with a big US mutual fund manager. He said, quote "The best

run in 2003 had all the junk stocks with no earnings, including

internet stocks" He sold them. He also sold Cisco, Intel and most techs.

If you remember we anticipated this. We come to the conclusion the institutions

will sell on the rally to Joe and Jane Public who will end up holding the bag.

Guess what,it is happening! He also said investment margin is at the new highs.

Joe Public is borrowing to jump on this train When I think about it right now

it is quite easy. It does not require conspiracy. The institutions are so big

they can move the market easily. First, they were buying techs. There were no

sellers! Now there will be simply no buyers.It is this simple.In Canada, I have

watched how it works. I have a small positions in some underperforming middle

caps stocks.At the beginning of each market rally the price unexpectedly jumps

up on a very low volume of few thousand shares and then it falls back. It does

not make sense unless you suspect someone is trying to "ignite the

rally" and backs off when there is no response. They wait for the news and

then enter a market order exceeding the quantity offered. The price jumps. Then

they watch if others jump on the moving stock. If they do, the rally quickly

becomes self-sustaining.Actually this is a normal, market action you would

expect from big players. Yesterday Canadian stocks sold across the board, including

gold shares even though gold remains steady over 400you were right here. I

thought it will stop 350 , then 375 now 400. I still cannot believe it will go

to 500. Simply because the biggest consumer, jewelry buyers have disappeared

and the old mines are being reopened. See gold supply/demand statistics on

Kitco. See Bema/Kinross anouncement on Refugio mine. See also Bema/Placer

announcement on building a new mine in Chile (Cerro Casalo?). Institutions know

the stocks are overvalued, they made good money and can go on winter vacations.

Big bonuses are due! Please note the paper gain is not the same as the actual

gain. To the big funds may want to lock their techs gains before year end or,

if they want to defer tax liability for a year, in early Jan 04. You can see

techs already coming off their lofty valuations for no apparent reason. Well,

there is a reason: John Doe swallowed the hook, the line and the whole rod.

Finally, Intel issued a warning today. The market is "not as good as they

thought" and their wireless diversification strategy is failing. Go

figure!So I do not think we will have to wait long. For a while I thought I was

crazy. Now I am patiently waiting for the inevitable.I must admit I also did

not fully believed what you said about banks. So this "capital

surplus" at Laurentian was a bit of a shocker. However, I cannot

condemn them. Quantized IS A CREDIT RISK, though probably worth taking. See you

soon. Stanley

PS. when talking about

Bombardier I have heard the word "crap" on TV.

[morning rant=ON]

Interesting. This was

predictable. This rally in techs was artificial from the very beginning

(11-09-2001). If you think about it and the trigger - it is easy to

understand why did the governments colluded and why did the regulatory bodies

pretend to look the other way and were talking about a woman rather then the

real money.

That triggering mechanism that you describe was very clearly recognisable in many exploration gold crap stock as well. I tried to hitch on a rise a few times, sometimes it worked, sometimes didn't.

The act 2 of the drama is comming to its tragic (for some) conclusion. Another indication is the all times high insider selling! A very good discussion on the subject is a recent article by Alf Fields on Kitco (US DOLLAR IMPLOSION - PART II) .

I also wrote a commment on "StanInvest" a couple of months ago [Wed 13 Aug 2003 1PM], trying to analyze the next stage of the development.

We are now facing a critical time when the Chinese and Japanese snapping up US Tbonds to keep dollars flowing will come to an end at some stage when the creeping depreciation of the US$ outweights the benefits of burgoeoning export trade Asia-->US. We could try to calculate this point by comparing the depreciation losses of the US Securities held in Asia with the actual gains from the trade: AFAIK the Asians hold about 3T$ worth of dollar denominated securities (half of this by China), whereas the trade imbalance is 0.6T$ per year. Therefore if the US $ depreciates at 20% a year, which it currently does against the euro and against gold, then the loss per year on securities is exactly equal to the trade surplus. Look at it this way: all the securities Asians are buying to keep excessive exports flowing to the tune of 600B$ a year, are in fact depreciating at - guess what, 600B$ a year! It is a zero sum game, and right now it is probably slowly changing into a negative sum game for the Asian side. From now on, the more securities they buy the bigger their depreciation will become, while insane promotion of the export will become more and more costly, because the raw material prices (e.g. metals and comodieties) are rising.

This situation has no easy work around

solution. For example, an attempt by the US gov to stop the fall by

jacking up the interest rates will result in a catastrophic fall in the value

of those securities anyway (=Asians would loose big way and instantaneously!),

while higher rates will trigger the simultanous collapse of: (a) stock market,

(b) real estate market

and (c) big debt corporate debt

default. Both sides are thus more interested in plodding along

rather then pulling the plug. However, the more time goes by the more Asian

will be paying and the more Americans will be laughing. Of course Asians

are no fools. They will probably not wait very long.

The most interesting question here is not what or when it (the dollar crisis) will happen, but what will happen afterwards! What kind of system will replace the current Asia-to-US gadgets export pump? Asians must continue selling goods to whoever buys them, otherwise they probably go back to the stone age. They are not self sustaining yet, like for example Europe. When dollar flops, the Europeans will watch in horror their currency becomming hard like a concrete, which will hurt their exports. Alf Fields writes that they will try to counteract and keep devaluing it to keep up with the dollar, although they won't be able to succeed, not only because their imbalance is not as huge as the US, the size is bigger, but in addition, the Asians and the rest of the world (including Americans expatriating their funds like crazy!) will probably start buying European paper securities which will put an appreciation pressure on the euro.

If you look at the whole situation from a distance, it looks like one economical superpower has printed and sold too much paper securities resulting in the inevitable currency devaluation, then another economical superblock is trying to follow the same policy (which is not that surprizing if you thing about it - it is run by the similar type of minds...). Other countries will have no choice, since their currencies is tied to either euro or dollar. There is no other viable choice - there are really two currencies in the world.

No, think about it - suppose you have big money to invest, what do you do? You shift your assets to the euro, right? Right, what next? Do you fancy watching the "deja vue"/BOHICO? Investing in the crashed stock (again), or falling real estate? I don't think so. Invest in Asia? You probably wouldn't want to. By that time they will be in a crisis too, their exports will most likely sag, besides their gummints will be busy devaluing their currencies as fast as they can to sustain their ONLY viable (in their minds) economical model - based on manufacturing and exporting!

Whatever it will be, the next optimal investment vehicle will probably not be:

- bonds

- stock

- real estate (buildings)

- development land in the cities

That leaves us with:

- precious metals

- commodities - food

- raw materials (industrial metals and

minerals)

- land (agricultural and recreational)

- works of art

- antiques

- intellectual property

- entertainment business (new type)

Re: "For a while I thought I was crazy. Now I am

patiently waiting for the inevitable. I must admit I also did not fully

believed what you said about banks. So this "capital surplus" at

Laurentian was a bit of a shocker. However, I cannot condemn them. Quantized IS

A CREDIT RISK, though probably worth taking."

I agree, but it's all in the

numbers. The risk is relative. The problem with the banks was that they

could not bring themselves to charging reasonable interest rates commeasurable

with the risk. Let's say that the risk of failure of small

businesses like Quantized is 5-10% every year (i.e. one out of ten failing

every year), then charging a 10-15% yearly interest on the loan would bring an

average return of 5-10% no matter what. Is it good enough for a

bank? Probably. However, banks seem to be operating under a fixed

interest doctrine. Their management seem to start with the initial

assumption that the interest rate must be always in the range of 6-8%, thus it

automatically precludes lending to the sectors that have higher than 1-3% or

so, inherent failure rate. It leaves only large stable corporations that

cannot possibly go bancrupt, companies like for example HotAir Canada, Nortel

Notworks or Fuckent.

Stan

StanInvest Wed

26 Nov 2003 2PM

Goldfiles (7)

Desert Sun Mining Corp.

DSM.TO (2.0C$)

Cap: 85M$ US

Resources:

Jacobina:1.4Moz Au

(2.5Moz inferred), 2.0Moz open pit mineable Au --> 800M$ US total mineable

value (@400$/oz)

projected cost per ounce: 190$/oz.

Asuming a cost of building a mine=100M: Net Project Value

NPV=2M*(400-190)-100M = 320M$ US

Cap/Res=800M/85M=9.4:1

Cap/NPV = 3.8:1

StanInvest Tue

25 Nov 2003 8PM

Goldfiles (6)

Canadian Golden Dragon Resources

Ltd. V.CGG (0.13C$)

Cap: 2.7M$ US 27.4M shares

Resources:

1) Vanguard Cu-Au-Ag property, in the

Shebandowan belt west of Thunder Bay, ON

Gold assays up to

16.5 grams gold/tonne (0.53 ounces/tonne)

- Mineralization with up to 6 grams gold/tonne

found along 200 m length

- Mineralization exposed over 20 m (66 ft)

width

Assuming 400X20X20m, at 6g/t, 390$/oz gives value of 30M$ US

2) Norton Zone Ni-Cu-PGE-Co Thunder Bay, Ontario

Old Norton Zone gave 940000t of 0.72% Ni, (67M$ at today's prices), and contains credits of up to 4g/t of Pt (est 90M$ ???). This is a gamble on whether they find equal or bigger deposits beyond or under the original zone (?).

Combined value of those

properties is probably about 100M$ US as of today, but it could be easily more

or less by a factor of 2.

Note: the stock is in the plateau stage at low

volume and falling fluctuations in a long wedge formation, plus the private

placement options were issued at higher strike price (0.15 and 0.2$) than the

current open market share price. Conclusion: it may be an

interesting speculative play on more positve new drilling results at the time

of favorable technical indicators for the stock.

Res/Cap=37:1 (18:1-75:1)

Bolivar Gold Corp. (BGC:TSX 2.3$)

Cap: 76M$ US, 43.6M shares

Resources:

Choco Project (Venezuela, Bolivar Province)

Average gold density based on 8 new sample

drillings along 400m section: 96g*m/t. Assuming width of 200m and rock specific

weight 2.5t/m3 gives 400*200*96*2.5/31=620,000oz of gold -->

242M$ * 70% interest = 169M$

Res/Cap=2.2:1

Comment: resources as they are known today are

more than fully priced into the stock, plus the deposit is medium sized which

is not that attractive. It may be a gamble on newly acquired

properties. Not a good one.

Metallic Ventures Gold Inc. (MVG:TSX, 8.7C$)

Cap=230US$

Res (Nevada): Esmeralda, Goldfield, Converse

950000+720000+1500000=1.2B$

Res/Cap=5.4:1

Agnico T.AGE (15$)

1B$ company with +/-10M$ income or loss per

year.

Impression: grossly overpriced

Currie Rose Resources Inc. (V.CUI)

Cap: 2.5M$ US 16.2M shares

Res:

The Scadding gold property, consisting of 2,880 acres of government leased claims. In 1997-98 10,800 feet of diamond drilling was completed by Currie Rose Resources Inc. with positive results. Previous mining recovered 15000oz of gold. The property was surveyed in the past. Gold deposit is probably small and uneconomical.

A 30% Net Profit Interest in 11,000 acres surrounding the Seabee mine in Saskatchewan. The Seabee mine is producing 60,000 oz of gold per year and is owned and operated by Claude Resources.

Reason to watch: reasonable

drilling results from their Scadding property 5.5g/t over 5m, 9g/t over

7m.

Overal impression: negative

StanInvest Thu

20 Nov 2003 1PM

Goldfiles (5)

Silvercrest Mines Inc. V.SVL

(1.28C$)

Cap=11.4M$ US

Res (Honduras): 5.6Moz Ag --> 30M$

(very high grade

silver deposit, from 100g/t to few thousands g/t, in an early stage of

exploration)

R/C=2.6:1

Comment: Company has been recently

involved in some struggle agaist the Honduran government, permits were not

cleared or revoked, equipment held by customs etc. On the face vale, by

the books, it is a clear money loosing proposition as it would require net

recovery after all the costs, of the 25% of the entire deposit in order just to

break even under the current valuation, which is virtually impossible given

that the company hasn't finished drilling and hasn't yet built anything on the

site. Based on the present valuation alone I am expecting the

company to be worth about 1M$ US before becomming attractive to buy, but

I can't see an exploration comany worth 1M$ being viable. Either way,

this situation does not make sense to me. However some investors

seem to be unusually enthusiastic about it, so I am putting it on the watch

list.

StanInvest Tue

18 Nov 2003 8PM

Goldfiles (4)

Royal Standard V.RSM (0.4C$)

Cap=8.3M$ US

Debt=25M$ (new corp bonds, Nov'03)

Res (Nevada):

Gold Wedge 1000'x100'x500'

at 0.06opt (assumed by SB) at 390$/oz -->83M$

(Gold Wedge is claimed to be the best property of theirs)

Carlin Pinon 310M$

Fondaway 60M$

Total 453M$

R/C=55:1

Comment:

Larsen, the CEO seems to be well regarded and

considered competent athough "naive" in terms of business acumen (by

Roulston). The company has been suspended by stock exchange in the

past for insufficient or improper paperwork. The scarcity of

info on their prime property may have a good reason or may indicate an

intention to obfuscate. I am not fully confident but I have a

feeling that that Nevada generally, not necesserily as RSM, may turn out

to be a safer and more profitable play that the remote Gobble deserts of Inner

Magonia.

StanInvest Fri

14 Nov 2003 2PM

Goldfiles (3)

Shore Gold (V.SGF, 1.77C$)

Market Cap: 30M$ (US)

Reserves: 500Mt of kimberlite ore, 0.3ct/t

How to value the reserves? It varies widely depending on quality of diamonds and sizes. On their website they quote that typical valuation achieved throughout diamond mining is 34-168$/ct, starting at 13$/ct. At 34$/ct the total value in the ground is 5.1B$

Res/Cap=170:1

StanInvest Thu

6 Nov 2003 9AM

Stan-to-Stan

Regarding theories I agree. They are

worth only as much as they are useful in practicce and in real life.

Regarding the real estate bubbles I disagree: they seem to be intricately

related to the inflated (=increasing) money and credit supply. Real

estate credit can be increased in several ways:

1) Low interest rates

2) Priniting more banknotes

3) Governmenetal credit risk insurance for the

banks

4) Reducing property taxes

5) Making other competitive forms of investment

unattractive, due to higher risk (e.g. small business) or bearish cycle (gold,

antiques, until recently)

At the moment we have factors 1,3 and 5 are strongly at play in the US, while in Canada factor 3 is much smaller than in the US, and 4 works in the opposite direction, since the property taxes have been rising steadily and fast.

Factor 1 is probably the most important and ties down with 3. The existence of gov guarantees plays a very big role in keeping mortgage rates low since otherwise banks would have had to factor in a much higher default risks.

Beauty of the non-interest bearing

investments like property and PM is that their perceived risk is capped from

the bottom. That is, it is possible to determine the worst case value of

the investment. For example, Canadian Maple Leaf 1oz silver coins worth

now 11C$ in retail, have a nominal value of 5C$, just like the worst case for

gold was 250$/oz. Therefore even if silver prices go to zero, you can

still recover 50% of your investment. No matter what. This is in a

stark contrast to the stock, where the downside is not limited, that is it can

and often does go to zero. Since PM have risen in the last 2 years

at a higher rate than much more more risky stock, it is quite surprising that

not more people have jumped in. To me it is no

brainer. The fact that most people would still

consider tech stocks shows that there was no real capitulation and that the

mind sets are still tech bullish which is itself a very bad sign. I

am extremely skeptical on tech stock because having worked there since 1988 I

have seen the flakeyness, mismanagement and the waste taking place in the

entire high tech industry since mid 1990-ties. I cannot force

myself to invest in something I know is not well run, wasteful and running out

of intellectual resources and new ideas at an alarming rate. I

cannot force myself to "invest" in something that seems to be only

marginally profitable if at all, while the entire operations are often so

thinly margined and leveraged to labor and material costs that moving even a

small part of the operation to India seems to be making a visible difference;

besides if I wanted to invest in cheap labor biz I would simply invest directly

in India or China rather then in those expensive hitech f...ups! The

margins are so small that most of those companies cannot now afford to put any

kind of real money back into R&D, thus must relly on the fast drying out

pool of acquisitions for new technology and products. This will not

of course work long term. This is the same disease that affected

the textile industry in the 1970-ties. Most people who

invest in Western hitechs now stand to lose everything - there is no other

way. High technology industry is the mature industry with the most

glorious days in the past, like airplanes, cars, railways, canals and

tulips. History does not repeat itself except as farse. People who

think that it is a rerun of 1982 boom are kidding themselves.

Stan P. wrote:

I am

not sure the basic assumption is right.

Ie inflation/deflation may be

broader then just money supply. For example

asset bubble is inflation but

has nothing to do with money supply. Housing

can go up regardless if Fed

prints money or not.

This is the problem with economists

and leftists

They have these great theories

on paper which do not work in practice.

Otherwise they should be all

billionaires!

----- Original Message -----

From: "Stan

Bleszynski" <stanb@ptbo.igs.net>

To: "Stan

Piotrowski" <SPiotrowski@eol.ca>

Sent: Wednesday, November

05, 2003 6:13 PM

Subject: StanInvest(2)

> You will love or hate this article:

> http://www.financialsense.com/fsu/editorials/hommel/110503.html

>

>

Stan P.

wrote:

Well

Canadians are patient folks. When a king wishes to raise taxes for example on

tea we pay, instead of throwing it into the harbour. I do not think it will

change soon. However, I now know there were "niches" in the communist

Poland where people behaved "normally". We just have to avoid the

traps in socialist Canada. I think it is possible. Banks can play ComDev

because serious money already gave up. BTW Air Canada is still over a dollar

despite multiple announcements the stock is worthless.

----- Original Message -----

From: Stan Bleszynski

To: Stan Piotrowski

Sent: Wednesday, November 05, 2003 6:34 PM

Subject: StanInvest(3)

More

Comdev: it's hard to believe that CIBC and Natbank, the underwriters of that

20M$C bought deal are engaging in this pumping scheme so blatantly and nobody

is raising a stink! It looks like they might be able to draw the price of

this medium sized company to any arbitrary level of their choice, for

example 10-15$ without any difficulty, just by circulating 50% of the daily

turnover among themselves while drifting it upwards by 5 cents every

day. Criminals.

Stan

Time Price Shares $Chng Buyer Seller

15:58 3.250 6,300 +0.370 CIBC Ntl. Bank Fin.

15:57 3.250 20,000 +0.370 CIBC Ntl. Bank Fin.

15:56 3.250 3,000 +0.370 CIBC Canaccord

15:56 3.250 1,000 +0.370 CIBC RBC

15:56 3.250 1,000 +0.370 CIBC Scotia

15:56 3.250 1,000 +0.370 CIBC Scotia

15:56 3.250 1,000 +0.370 CIBC Scotia

15:56 3.240 100 +0.360 CIBC Anonymous

15:56 3.240 900 +0.360 CIBC Anonymous

15:56 3.240 100 +0.360 CIBC Ntl. Bank Fin.

P.S.

You were right that major

shorting is impossible in this circumstances. This particular stock has

been abandoned by institutional investors a few years back after the major

managerial f..ups and waste, and especially after it dropped from 40$ to 4$,

and then again from 20$ to 1$. Thus no major portion of the stock is in

the hands of one investor (except the founder Val Donovan who has 13%) ,

therefore there is no potential for major external short. The company is

also small enough, smaller than the underwriting banks themselves such that

even if the whole scheme went sour it would not jeopardise them. And

the amount of floating stock is small enough that 0.5M churned daily is capable

of controlling the whole thing. I wonder, could something similiar also

explain Nortel, but done by bigger players?

StanInvest Wed

5 Nov 2003 11AM

She Comes to Work At Dawn’s First Light

She

comes to work at dawn’s first light

And stays long after darkness falls;

She never shirks from deadlines tight

Or passes on the hardest hauls;

To make dumb projects turn out right

She always knows the best cure-alls.

It’s

not the pay, not power lust

That keeps her focused on her tasks;

An inner voice she’s learned to trust

Is the cocoon in which she basks;

To lesser goals she won’t adjust,

Her love of best is no mere mask.

All

managers well know her type,

They seek it out and secret gloat;

No burden wrings from her a gripe,

She bears the load as they showboat;

While others bubble up on hype

It’s her that keeps the boat afloat.

©

2003 Michael Silverstein

www.wallstreetpoet.com

StanInvest Fri

31 Oct 2003 12PM

Thumb down

I had a strange feeling when I read Dryblower's comments:

http://www.miningnews.net/storyview.asp?storyid=19157§ionsource=s27

SOMEWHERE in London is an investor who is

not happy with gold. He's the unlucky chap who bought an ounce of gold for

US$391.85 at the morning fix on September 25. ...

Why is he making such a big deal and is trying to ridicule this? It is a common occurrence that someone might buy at the local peak. The same may be happening at the local minimum, some are simply lucky or foresightful, some are not. I don't see anything funny about it. Especially that the price of gold may go either way. Is it a big deal? No, its normal. Secondly, many people consider the probability of gold going up much higher than going down, for the reasons that we already discussed - it has to do with the way governments think and act. This buying at 391$ was not as crazy and irrational as Dryblower thinks. At least not as irrational as buying Nortel at 80$ or Yahoo now at 43$! Even if you believe that gold must go back to 250$ at some stage, then they guy who bought it at 391 would still retain 64% value of his holding, which is not the case for many retirees and small investors that invested in stock!

My impression is that the guy sounds terribly bitter and bearish, and for some reason decided to jeer everyone who disagrees. Besides, just as I write this, gold Feb futures stand at 390.50$ so it is possible that it may in fact be that "unhappy" nameless investor who will be rolling on the floor laughing his a..s off while reading Dryblower's comments.

Stan B.

StanInvest Thu

30 Oct 2003 5PM

Goldfiles (3)

GBU Gabriel Resources

I agree, I could smell a rat even

in the first paragraph of the news release:

" The Company plans to use the

net proceeds of this financing [45M$] for the advancement of its mineral

properties, and for general corporate purposes."

Mind you, they are not saying "to

build a mine", nor give they any meaningful details pertaining to the

future operation not even a mine feasibility study. For f..k sake why on

earth would they want to "advance mineral properties" while sitting

already on 3.9B$ worth of gold, rather then just build a few mines, each in one

of the already existing pits!

Cap: 390M$ US

Reserves:

Rosia Montana 10Moz

Au --> 3.9B$

Bucium Tarnita 1Bt

of ore with 0.32% Cu --> 64B$

R/C = 10:1 (based on just Rosia

Montana) = 174:1 based on all

Comment: I learned to dislike mining operations that quote: "the area was mined for gold for 2000 years", and was also heavily investigated but NOT MINED by the Romanian communist gov for a long time. By stating this, they imply that previous miners/owners from Romans and Greeks to Ceasescu were stupid and left all that gold in the ground waiting for our ingenious MBA's to pick it up.

StanInvest Tue

28 Oct 2003 10PM

Goldfiles (2)

MAN.TO

Manhattan Minerals (1.26C$ 28-Oct-03)

Market Cap: 52.9M$ US

Resources:

All in Tambo Grande,

Northern Peru (coastal area).

Three main deposits:

TG1: open-pit mineable

8.2Mt ore of

3.3g/t Au 347M$

59g/t of Ag 84M$

57.8Mt of

1.5% Cu 1740M$

0.9% Zn 480M$

0.5g/t Au 370M$

25g/t Ag 250M$

---------------------

Value: 2840M$

Note: the company has published an open-pit mine feasibility

study which indicates that at the total cash cost of 325M$

the mine will produce 275M$ net profit out of Au and Ag,

(over 3.5 years of the lifespan of the first upper layer), plus

total net profit of 758M$ out of Cu,Zn,Au,Ag during the

second deeper phase (which will last 9 years). These figures

allow calculating of a very useful parameter called

Net Project Value (NPV) = 275+758-325 = 708M$

They also indicate that because of the two stage

"bootstrapping" the real up-front investment needed

to start the mine is 180M$. This is important given the

small market cap of the company, at present.

This capital can easily be raised through stock dillution

plus bank loans&bought deals.

B5: underground

mine (400m)

size

similiar to TG1, more copper

Value:

Not Assigned

TG3: I am not

sure if open pit mineable (?) 100-400m deep

very large deposit 82Mt of

1% Cu 1640M$

1.4% Zn 1060M$

0.8g/t Au 840M$

25g/t Ag 360M$

----------------

Value: 3900M$

Ratio

Resources/Cap=(2840+3900)/52.9 = 127:1

Ratio NPV/Cap = 708/52.9 = 13:1

(based on only one deposit TG1)

Comments:

I had a feeling, looking

at other gold prospectors that the R/C ratio should really be above 10 to make

it worthwile. This company confirmed this estimate, since it seems (if

typical?) that only 10% of resources may be counted as net profit.

I am sure it depends on the location and the type of mineralization.

Second comment, is that MAN has been hit by a political dispute with the

local town mayor (Tambogrande) . I expect this to fizzle out, becasue

some/many of the local people are in favor, but it may be a good opportunity

(being contrarian) because the stock was slightly down this week. I

haven't seen that many juniors with such advanced operation studies. It

looks like these guys want to start minng ore, not paper, and are preparing

well towards it.

StanInvest Mon

27 Oct 2003 6PM

Goldfiles (1)

I am opening a new record file of our gold

& other mining stock analysis, for the record. These messages will be

numbered sequencially and start with the keyword "Goldfiles"

____________

WSA.AX Western Areas

Western Areas has announced that assay results from diamond drill hole FFD 133 at the new Flying Fox discovery at Forrestania have confirmed an outstanding intersection of 21.4m @ 7.8% nickel from 494.75m downhole depth. The intersection is almost identical in grade to an intersection of 6.6m @ 7.9% nickel in the first drill hole FFD 132 110m to the north. The massive sulphide in FFD 133 occurs immediately below an interpreted flat lying granite dyke. Although only two drill holes have been completed to date, both intersections point to the potential for the discovery of a major deposit in terms of grade as well as size. Cross sections and longitudinal projections showing the location of the two drill holes, known EM anomalies and the proposed future drilling program are being updated for release.

GIP.AX Gippsland

Ltd. Ta

Market cap: 5.6M$ US

[S.P.]] Finally this company has 100 mln shares plus 38 mln share options. Fully diluted, this means market cap of about 10 mln $ (australian). I have a feeling this feasibility study will be positive. They estimate NPV net present value of a company, at 10% discount to be 84 mln A$. I can wait a few years for an 8-bagger to happen! Please also note they are exempt from Egyptian taxes for 20 years - life of a mine. Note the wealth of information on their WEB site. They are much more open and professional then [...]. After all, they are all descendants of convicts, so they know the price of dishonesty :-). Look at their WEB site. No bullshit whatsoever. Very professional.

[update 30--Oct-2003]

Abu Dabbab and

NUWEIBI project (50% interest), Tantalum-feldspar, total & inferred 122Mt

ore:

feldspar: 40Mt , value 80M$ US net over 5 years 2005-2009

Ta2O5 22M lb --->

1.5B$ (assuming 70$/lb )

Nb2O5 10M lb --->

0.2B$ (20$/lb ?)

Sn

35kt ---> 0.2B$ (5300$/t)

--------------------------

Total 1.9B$

Asssuming 68%recovery, 5$/lb production costs (net Nb and Sn) and 50% interest,

it gives a quasi-net project value of 22Mlb*0.68*65$/lb*0.50=490M$ (US$)

Res/Cap = 0.50*1.9B$/5.6M$ = 170:1

NetResources/Cap = 88:1

Note: Tantalum prices are volatile!

TM.V Tumi

Resources Ag

Market cap of 5M$.

Have 60% of resources

worth 180M$ = 108M$

Res/Cap ratio is 20:1

ARU Aurelian

Market cap of 8M$US

Resources:

Aguas

Mesas Sur:

Assuming in the best

of cases that the zone extends 10m in each XYZ direction it gives about 3000t

of quartz, at even optimistically 100g/t (avr) it contains about 4M$ worth of

gold at 370$/oz price. The real market cap of ARU is not Aguas Mesas

Norte contain 2-40 (avr probably 5g/t) along 10m section. Again assuming

10x10x10m=3000t gives about 0.2M$US worth of gold. Measurable gold reseources

worth at this time of 4M$

Res/Cap

ratio = 0.5:1

Unless they increase

reserves by a factor of at least 20 (which is not impossible) they are not

attractive, especially that there exist prospectors

which own 100:1 or

higher ratio already. A disruptive conflict with the local established

illegal miners may be a possibility.

CDU Cardero Res.

Market cap: 36M$

Measurable

resources: 63M$

Res/Cap

ratio: 2:1

Tthe stock has been

recently doing reasonably well. Their silver property on Argentina

is near the one previously drilled and

rejected by Barrick,

what they got is a 10X150X70m chunk of a rock with 18g/t of gold and 115g/t of

silver.

SJD resources:

Hwini:

936000oz Au

Goulago:

700000oz Au

Rounge:

75000oz Au

Benso probably 20000oz Au (?)

Total

worth about 400M$US (accounting for 60% interest)

Market cap 25M$US

Resources-to-cap

ratio of 16:1

NAV Navasota Res

Resources:

Turner Lake

(NT): 210,000oz Au

Taurus (BC):

1.6-3.2Moz (estimate)

Market cap: 4.6M$

Res/Cap=130:1

ER Eastman Resources

Market cap: 14M$US

Resources:

Clearwater:

600,000oz Au

Abitibi

Extension ?

Plummer

Additional ?

Railroad/CNE ?

Reservoir

(gold, copper) ?

Lac Elmer

(gold) ?

Lidge

(gold) ?

Lac Hudson

(gold) ?

Akweskwa

(gold, zinc) ?

Rocky

Lake/Otter Brook (zinc) ?

Tingley Brook

(zinc) ?

Ratio 16:1 based on

Clearwater project alone

Northern Orion

Res (2.8C$ 22-Oct-03)

Market cap: 213M$US

Resources:

Alumbrera:

25M$/yr

cash income, est life span 6-15yr from now --> total assets =150-370M$

Aqua Rica:

10M oz

of Au @ 380$/oz = 3.8B$

18B lb

of Cu @ 0.91$/lb = 16.4B$

Total: 20.4B$

Res-to-cap

ratio: 96:1

NPG.V Nevada Pacific

(0.74C$ 22-Oct-03)

Market cap: 3.9M$US

Documented reserves:

Limousine Butt

(Nevada): 50% of 620,000oz Au --> 118M$US

Plus 5 other projects

of unknown value (also in Nevada)

Res-to-cap ratio:

30:1

CNI Canico

Res. Corp.

2Mt of mineable Ni at

11500$/t = 23B$

Market cap: 330M$ US

ratio 69:1

Top buy recomendation

by Jennings analysts.

EXR Expatriate

Res. Zn,Cu,Ag,Au ( 0.27 C$ 24Oct02)

CAP=9.7M$US

Resources:

1) Blue Moon

(California):

700M$ Zn + 55M$ Ag

2)

Logan+Wolverine project (South Yukon, near Whitehorse):

1420M$ Zn + 170M$ Cu + 58M$ Pb + 430M$ Ag + 135M$ Au

3) Selwyn

Basin, HP and Nod claim (Northern Yukon):

5400M$ Zn (inferred 18000M$ Zn)

Note: they say that this deposit is feasible as an open pit

operation only under the condition that Placer Dome will

develop their own even bigger nearby deposit and builds

processing facility and full mining town.

-------------

Total:

8.4B$ (possibly 21B$)

Res/Cap=860:1 -

2100:1

Positives:

- Extremely rich

resources, both very good grade Zn ore and volume. Very high

resource-to-market cap ratio which indicates that the company may be severly

undervalued. The viability of achieving a real mining operation is

high due to large deposit size and bullish prognosis for Zn prices.

Negatives:

- Only about 10% of the overall resources value is in silver which will makes it less likely to be carried by the forthcomming possible much higher silver prices.

- Viablity of Selwyn depends on the other company's decision. The fact the Placer Dome hold deposit reserves nearby their own (Selwyn) which is possibly much larger (1Bt @ 5% @ 920$/t = 46B$) puts a damper on the future zinc pricing. Similiar situation may in fact exist in other parts of the world, i.e. the existence of very large Zn deposits waiting to be activated when prices improve somewhat.

- Blue Moon deposit is promissing and easy but I am not sure whether People's Republic of California is the right place to open a mine at the moment (?).

- Location of the Logan+Wolverine project is probably not very easy but not as bad as Selwyn. A big open pit & processing plant has to be built. The costs are substantial and may eat a significant portion of those 2.2B$ resources (200M$ ??) but may be doable. However this project contains 26% value in Ag+Au thus may become suddenly viable if precious metal prices explode.

BWR Breakwater Res.Zn

Cap 93M$ US

Resources:

18-28B$ worth of Zn

Res/Cap=193:1

Comments:

They appear to be

high grading their ore to reduce cash costs and break even (see slide

#14). It does seem to be working. At the same time it means that as

soon as prices go up their cash costs will also go up because they will have to

do the opposite to preserve their assets. It puts a cap on profit margin.

Northgate (NGX, 2.4

C$ 24Oct03)

Cap: 382M$ US

P/E: 12.6 (!)

Short ratio:

0.08% (!)

Resources:

Kemess 6.6Moz Au +

2.4B lb Cu = 4.7B$ gross value

Res/Cap = 12:1

(gross) = 2.8:1 (net mineable recoverable after cash costs subtracted)

International Taurus Res.

(ITS.V)

CAP: 7M$ US

Resources:

Fenelon Gold (NW

Quebec) 62%: 2.5Moz Au ----> 600M$ (gross)

R/C = 85:1

NRI

NovaGold Res. (4.9C$, 23Oct03)

CAP 188M$ US

Resources

Donlin Creek (with Placer Dome): 25Moz

Galore Creek: 5Moz

Total: 30Moz Au --> 11B$ (I didn't check what interest Placer

Dome has got)

Res/Cap=61:1 or less

Probably too late. This is one of my favorite stocks [S.P.]. I was watching them for 2 years, starting at $1.60 or even less. They have 30% of Donlin and have started a new company to develop their other 4 projects (will start trading in a few days). NRI is an excelent company. This is a real estate outfit from Nome which generated cash flow from real estate and gravel while looking for gold. They found 4 good deposits. I considered many times buying it, last time as recently as 3 months ago when they fall below $3, but I could never put $ value on them. Placer bought back 70% and it is now up to them (how and when).

Starfield Resources SRU

Cu,Ni (0.22C$, 23-Oct-03)

Market cap: 10.9M$US

Resources:

Nunavut

Drilled:

6.7Mt of ore open pit minable (100m)

0.92% Cu --> 123M$

0.65% Ni --> 501M$

1.39g/t Pd --> 62M$

0.2g/t Pt --> 33M$

Total: 719M$

Inferred:

54.8Mt of ore, similiar grade as above

Total 5.9B$

Resources to cap

ratio:

drilled: 66:1

inferred: 540:1

Warning

signs:

- stock langushing for 3 years

- original deposit discovered by Inco in 1950-ties but not utilized, and leased

to SRU in 1999.

This is a good illustration of what you were saying about big resources not always being viable. This is a risky play on the confirmation of the "inferred" resources, if it is the case then this will be immediately 10X higer.

SRU problems:

1. There is no road

and no infrastructure. Supplies and equipment are brought by air with planes

landing on ice.

2. Part of the deposit

is under lake, probably unreachable (environmentalists, natives)

3. Over 50% of

in-situ value is nickel. Geol. documentation mentions 30% of nickel may be

unrecoverable due to the kind of minerals involved

4. There is a 3% NSR

royalty

5. Only part of the

deposit, Western Pit area, is accessible through open pit. it is only 6 mln

tons indicated.

6. There is a model

of the deposit which shows it steeply deeping out of reach for bulk mining.

7. I would prefer

more tonnage and higher grades.

SRU advantage:

There are two

absolutely fabulous geological reports on their WEB site which permit to

reconstruct all work done so far and essentially

model the resource

with great accuracy.

It is hard to read

.PDF, but it can be blown-up, printed and even shown to a geologist

------------------------------

StanInvest Mon

27 Oct 2003 4PM

S-2-S

MBA or Master Of Disaster?

I decided to salvage those 2 messages to be able check in a couple of years how wrong or how right we have been...

Subject: Re: BN2

Date:

Sun, 26 Oct 2003 08:51:09 -0500

From:

Stan P.

To:

Stan B.

It is not this easy.

First, the money has nowhere

to go. We already see the results in the US stock market.

Second, big part of US deficit

is the cost of war. Despite very bad press and daily loss of life I think they

are doing well. I am surprised they did not more effort into Iraqi oil exports,

but this would stink as colonialism. They are building up iraqi police and

army. This actually may be the solution. I also think we will see a 4% GDP

growth in US this year due to higher productivity. What really worries me is

the debt and pension plans liabilities. However, contrary to you I think they

will keep interrest rates low for the next few years. There is so much slack in

the economy the wage inflation is subdued. There will be lower standard of

living and higher commodity cost, but no inflationary spiral. Finally, there is

a war factor. US used to be run by WWII generation, like Kennedy and Bush.

Recently Clinton was a dope smoking draft dodger and the dope smoking MBA's

tooke over. The history will repeat itself. These soldiers in Iraq are now

forming an unbreakable bond and resistance to bullshit of the kind that men

form only at war. When they are back the MBA fuckups will find their match.

Twenty years from now these people will run the country. They are earning it in

blood. So far the US public stands firmly behind them. This is not Vietnam,

this is self-defence. There are things the spineless liberals will never

understand. For now, they have lost any shred of influence over 150,000 men and

women. The French, MBA's, "f...en docents" and politicians will pay

the price for this error. We both agreed the core of North American

problems is the system paralysis created by bad management. Incompetent fuckups

took over. A bunch of lawyers and journalists can bully or manipulate a

housewife or a factory worker, but not the battle hardened young veteran. The

debt and everything else "is only money". It all starts in the head!

-----

Original Message -----

From:

Stan B.

To:

Stan P.

Sent:

Saturday, October 25, 2003 9:12 PM

Subject: Re:

BN2

Re: "The question is now, as before, how far and how fast the dollar will fall."

My guess is that it will happen faster than in the wildest dreams and deeper than in our imagination. I suspect that once it starts the entire world will be rushing to get rid of them. This may trigger a self-propelled financial vortex:

- rising

depreciation, deficit trade imbalance

will trigger

- rising

interest rates

will trigger

- stock and

property markets collapse

will trigger

- masive

outflow of foreign investors out of US market

will trigger

- collapse in

the dollar exchange rate

will trigger

- sharp

recession in Asia due to decline in US imports

will trigger

- cashout of

even more foreign investments in the US

(Japan did it

after their crash in 1990)

will trigger

- general

softness in the economy (slightly understated) and lots of other fun

Canada has

debt to GDP of 100% (?) but it is Canadian problem, the small local effect,

just as Ireland used to have 110%. This may or may not affect the currency.

However in the US it is only 30% but its currency was treated like gold. The

failure if it happens will be total profound and merciless.

Stan

StanInvest Wed

8 Oct 2003 1PM

S-2-S

More cynicism

http://biz.yahoo.com/rb/031008/markets_bonds_4.html

That drop took the stock-to-sales ratio to a record low of 1.20 months. Normally, that would be encouraging for growth going forward since analysts assume businesses will have to rebuild inventories at some point. However, many of the sectors that reported falling inventories also reported falling sales, suggesting the de-stocking was voluntary. The stock-to-sales ratio has been falling for two years, perhaps reflecting improvements in supply chain technology such as "just in time" processing. If so, any rebuilding of stocks could be modest and provide far less of a boost to economic growth than in previous recoveries.

As a footnote, I must add that I always regarded a JIT processing as a screwup because:

a) It eliminates buffering of inventories from the top and middle chain, shifting it down to almost raw materials and mining. As you well known from thery of automation, if you remove an integrator component out of the feedback loop (e.g. a capacitor), it usually becomes unstable.

b) To make they system stable, it has to increase the inventory elsewhere in the chain, usually in the material supply and in the retail of end products.

c) It may have contributed to the last 10 years of a deadlock in Japanese

economy.

To view previous StainInvest blog click here:

Previous

Stan Bleszynski

1668

Lakehurst Rd.(Buckhorn), Lakefield

K0L2H0, ON, Canada

(705)657-2419 Fax (705)657-8157

http://www.ptbo.igs.net/~stanb

stanb at ptbo.igs.net

THIS

IS PRIVATE WEB-PAGE, COPYING AND LINKING PROHIBITED EXCEPT BY AUTHORS'

PERMISSION.

Copyright: Stan Bleszynski, 2003